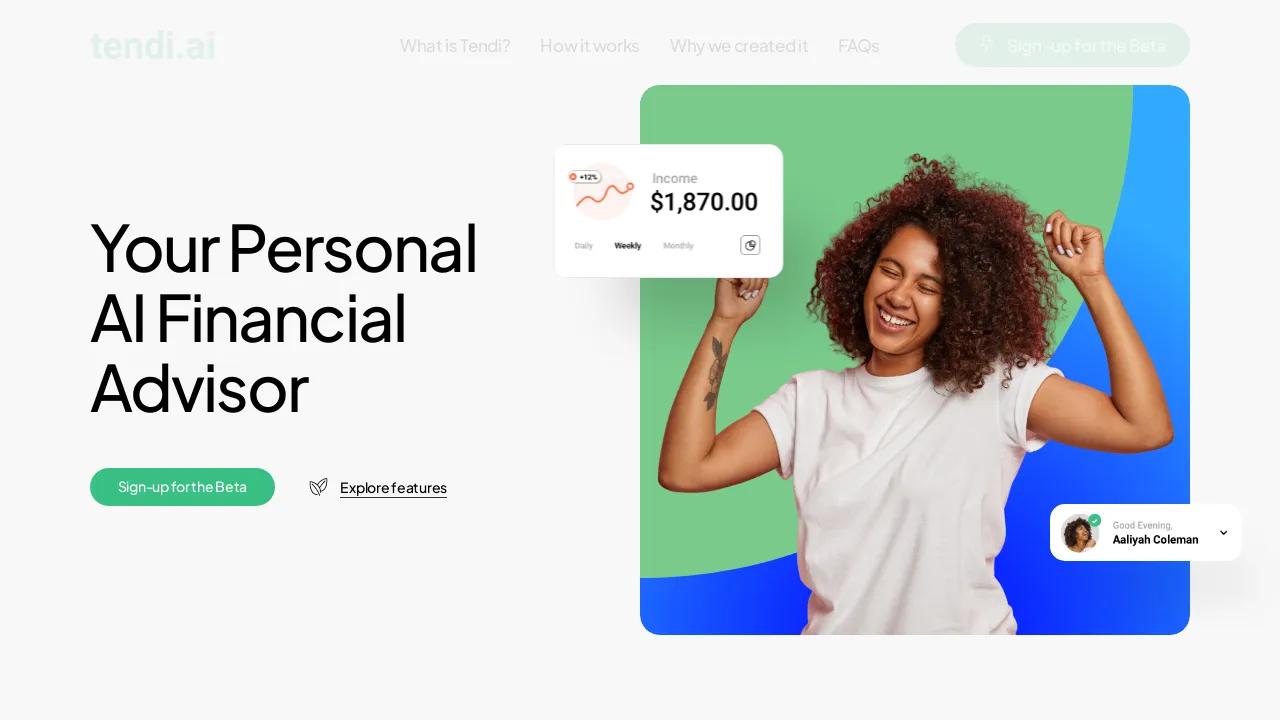

Tendi

Tendi is an intelligent financial advisor designed to help you achieve your financial goals, no matter your experience level. It provides personalized financial guidance, based on your individual circumstances, to help you make informed financial decisions. Tendi's advanced algorithms, developed by a team of AI and finance experts, analyze your financial data and offer tailored advice on saving, investing, debt management, and retirement planning.

Highlights:

- Empowering everyone: Tendi aims to make advanced financial tools accessible to all, helping to bridge the wealth gap.

- Personalized advice: Get customized recommendations based on your unique financial situation and goals.

- User-friendly interface: Tendi is easy to navigate, even for those new to personal finance.

- Secure and private: Your data is protected with advanced encryption and strict privacy protocols.

Key Features:

- Bank account linking: Connect your bank accounts for a comprehensive financial picture.

- Goal setting: Define specific financial goals, such as saving for a down payment or retirement.

- Budgeting and savings insights: Identify areas for improvement and track your progress.

- Investment recommendations: Get tailored investment advice based on your risk tolerance and time horizon.

- Debt management strategies: Develop a plan to pay down debt efficiently.

- Retirement planning tools: Estimate your retirement needs and explore different strategies.

Comments

Please log in to post a comment.