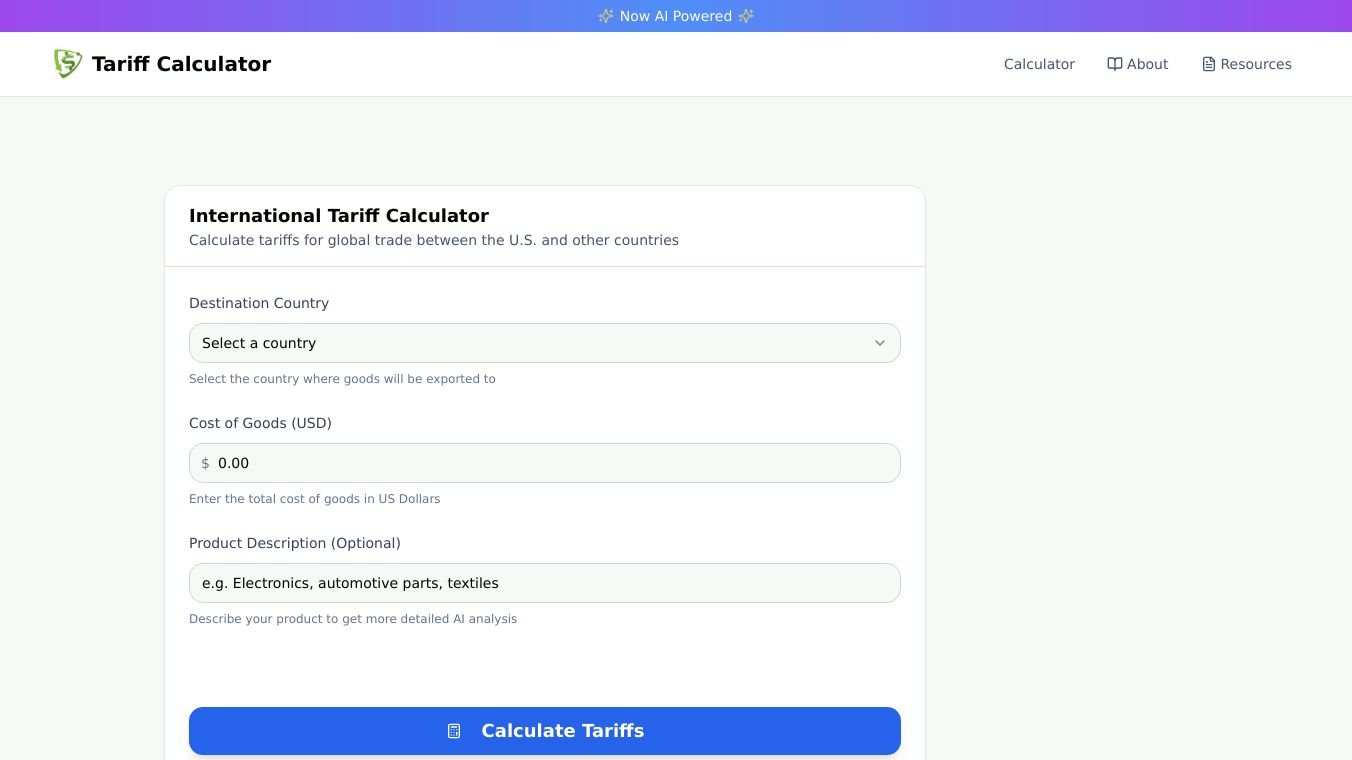

Tariff Calculator

Tariff Calculator is a handy online tool that helps you understand how tariffs affect the prices of everyday items. It makes international trade policies easier to understand, so you can make better buying choices.

Benefits

Tariff Calculator shows you the hidden costs of imported goods. This helps you compare prices better and plan your budget. It also helps you see price changes based on trade policies. The tool is simple to use and gives a clear view of total import taxes. It thinks about things like product value, quantity, duty rate, and VAT, along with extra costs like insurance and shipping.

Use Cases

Tariff Calculator is great for individual shoppers and business owners. It is useful for anyone who wants to understand the true cost of imported goods. Just enter details like product value, origin country, and product type. You can see how tariffs affect the final price. This is especially helpful for comparing prices across different products and planning for potential price changes.

Additional Information

Tariff Calculator thinks about various factors that influence import costs. For example, it considers the ''De Minimis'' rule, which exempts personal goods valued under $800 from duties. This is useful for travelers and online shoppers. The tool also accounts for additional fees like the Merchandise Processing Fee and the Harbor Maintenance Fee. Plus, it recognizes benefits from Free Trade Agreements, which can reduce or eliminate duties on goods from certain countries.

Comments

Please log in to post a comment.