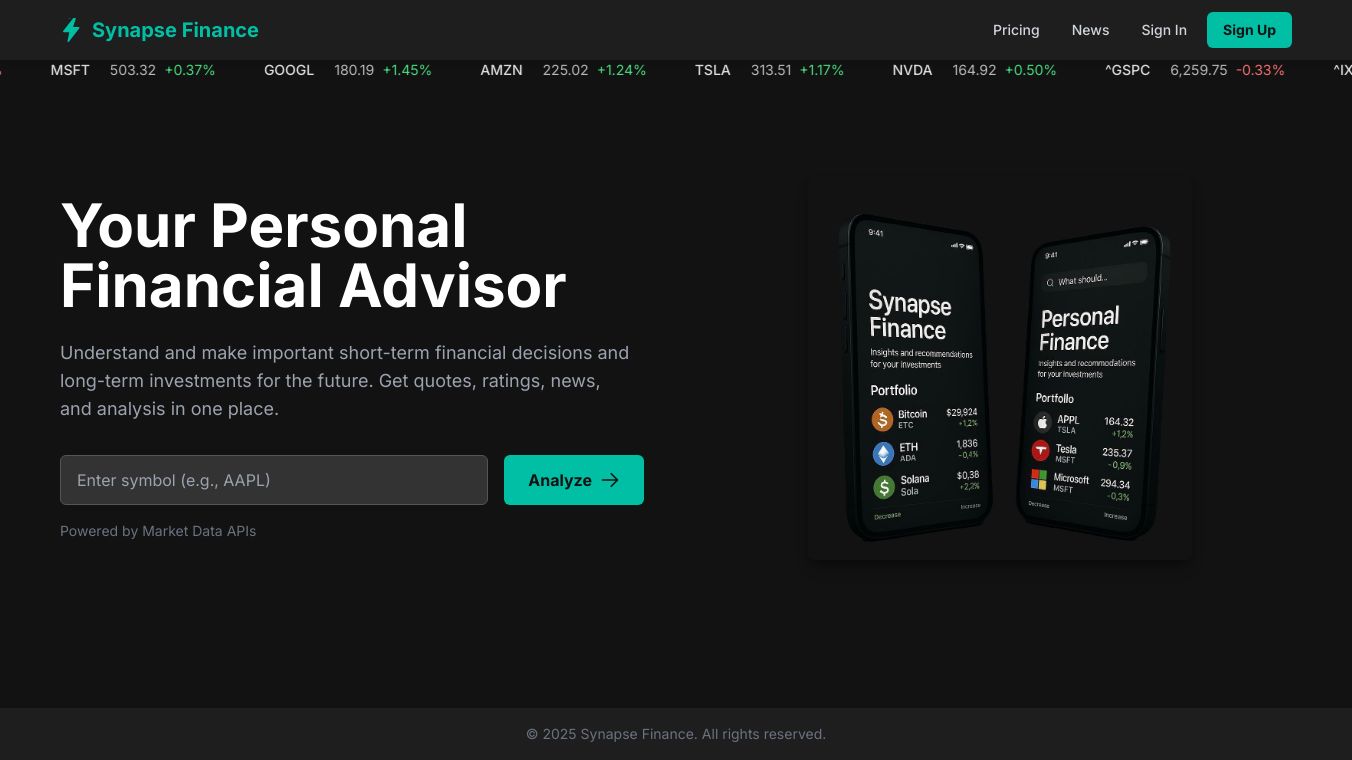

Synapse Finance

What is Synapse Finance?

Synapse Finance was a fintech company that acted as a bridge between financial technology companies and banks. It provided essential services that allowed fintech apps to offer banking features to their customers. By connecting fintech platforms with traditional banks, Synapse helped streamline financial operations and expand the reach of digital financial services.

Benefits

Synapse Finance offered several key advantages:

- Seamless Integration: It enabled fintech companies to easily integrate banking services into their platforms, making it simpler for users to access financial products.

- Expanded Reach: By partnering with banks, Synapse helped fintech apps offer services to a broader audience, including those who might not have access to traditional banking.

- Efficiency: The platform streamlined financial operations, reducing the complexity and time required for fintech companies to manage banking services.

Use Cases

Synapse Finance was used by various fintech companies to provide banking services to their customers. For example:

- Yotta: A fintech app that offered savings and investment services, relying on Synapse to manage customer funds.

- Juno: Another fintech platform that used Synapse to provide banking features to its users.

These use cases highlight how Synapse played a crucial role in the fintech ecosystem, enabling companies to offer innovative financial products and services.

Vibes

The shutdown of Synapse Finance has been met with significant criticism and concern from customers and industry experts. Many users of fintech apps that relied on Synapse have reported losing access to their funds, with some receiving only pennies back from their banks. This has led to a loss of trust in the Banking-as-a-Service (BaaS) model and raised questions about the oversight and transparency of intermediary platforms.

Additional Information

The collapse of Synapse Finance has prompted calls for stricter regulations and better oversight in the fintech industry. The Federal Deposit Insurance Corporation (FDIC) has proposed changes to ensure that consumer funds remain accessible during intermediary failures. However, industry experts have noted that these measures do not fully address the root causes of the Synapse collapse. The incident serves as a wake-up call for fintech companies and their banking partners to prioritize robust oversight, transparency, and contingency planning.

Comments

Please log in to post a comment.