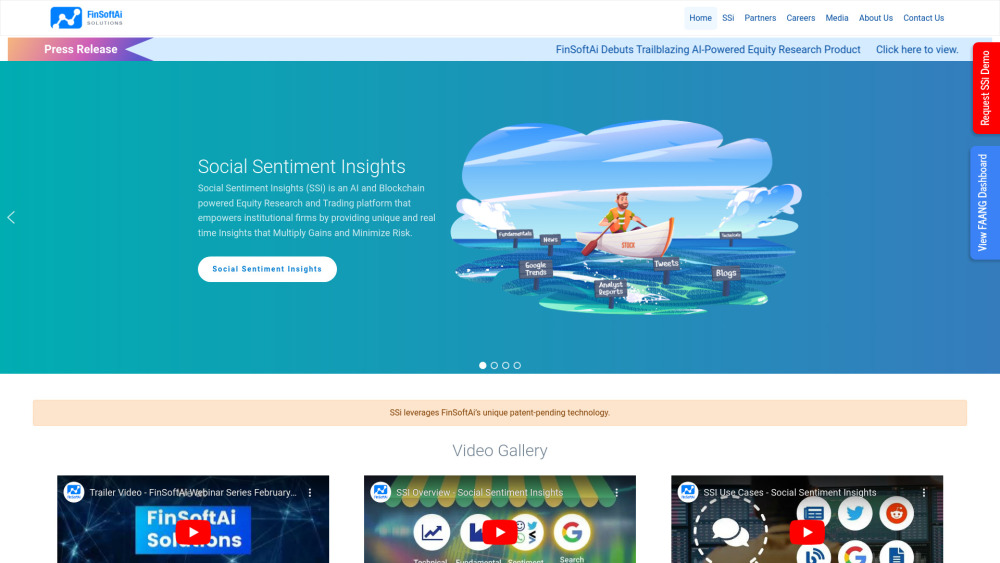

Social Sentiment Insights (SSi)

Social Sentiment Insights (SSi) is a cutting-edge platform developed by FinSoftAi, designed to harness the power of artificial intelligence and blockchain technology to analyze social media sentiment within financial markets. This innovative tool aims to assist institutional investors, traders, and financial firms in making more informed and timely investment decisions by providing unique insights derived from social media data. SSi offers a comprehensive suite of products, including sentiment analysis, social buzz tracking, and trading signals for stocks and other financial assets. The platform utilizes machine learning and natural language processing to aggregate data from multiple sources, analyze sentiment, and generate actionable insights, thereby helping users maximize gains while effectively managing social risk.

SSi's multi-source sentiment analysis aggregates and analyzes data from social media, news, and other sources to provide comprehensive sentiment insights. It offers real-time sentiment indicators, alerts, and trading signals through various channels, including APIs. Customizable dashboards are provided, featuring sentiment analysis, social buzz trends, and visualizations like word clouds. Additionally, the platform uses a private blockchain to enable secure collaboration, transparent commission calculation, and compliance.

The platform is designed to cater to various use cases, such as investment research, trading, social risk management, and ESG analysis. It helps research analysts monitor retail sentiment and social trends to inform investment decisions, provides traders with real-time sentiment signals to identify trading opportunities, and allows institutions to monitor social sentiment to avoid risks like meme stock events. Furthermore, SSi enables the analysis of social sentiment around environmental, social, and governance factors.

Comments

Please log in to post a comment.