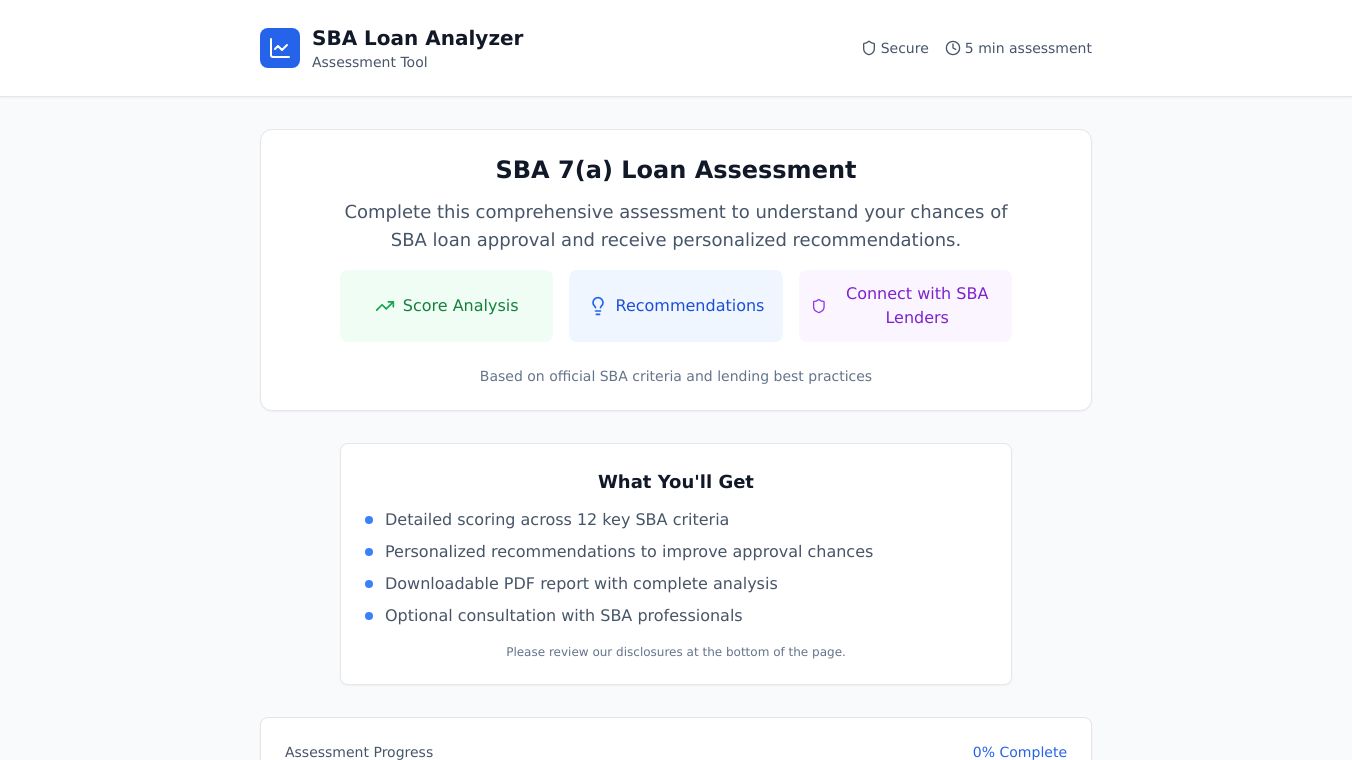

SBA Loan Analyzer - AI-enabled

SBA Loan Analyzer - AI-enabled

SBA Loan Analyzer - AI-enabled is a cutting-edge tool designed to simplify and speed up the process of applying for Small Business Administration (SBA) loans. This AI-powered solution helps small businesses navigate the often complex and time-consuming SBA loan application process with greater ease and accuracy.

Benefits

The SBA Loan Analyzer offers several key advantages:

- Increased Efficiency: The AI model significantly speeds up the loan approval process, making it up to 3 times quicker than the industry average of 5 weeks.

- Accurate Predictions: By analyzing historical data and trends, the AI accurately predicts the likelihood of SBA loan approvals, ensuring that applicants are well-informed about their chances.

- Improved Customer Experience: The AI model interacts directly with applicants, providing a more personalized and streamlined experience. It targets the right customers for the right SBA programs, enhancing the overall customer journey.

- Expert Support: The AI model is integrated with the underwriting team at FastwaySBA, ensuring that applicants receive expert guidance throughout the process.

Use Cases

SBA Loan Analyzer - AI-enabled is particularly useful for:

- Small business owners looking to secure working capital term loans.

- Financial advisors and referral partners who want to better service their clients by providing accurate pre-approvals.

- Businesses in SBA-preferred industries that require quick and efficient access to capital.

Additional Information

The AI model behind SBA Loan Analyzer was developed by American Capital Group, the parent company of FastwaySBA. It was initially trained with a vast amount of historical SBA funding demographic data and trends. Through advanced machine learning techniques, the model has discovered hidden patterns of successful SBA applicants, allowing it to segment customers based on predictions of outcome.

FastwaySBA, a New York-based SBA capital advisory firm, provides SBA guaranteed loans to American small businesses through partner banks. The implementation of the AI model has not only increased the efficiency of the SBA loan process but also created a way for clients to obtain loans with speed and ease.

American Capital CEO Alex McAloon has praised the AI model, stating that it complements the company's pre-existing fintech processes and has significantly improved the SBA loan process with their bank partners.

Comments

Please log in to post a comment.