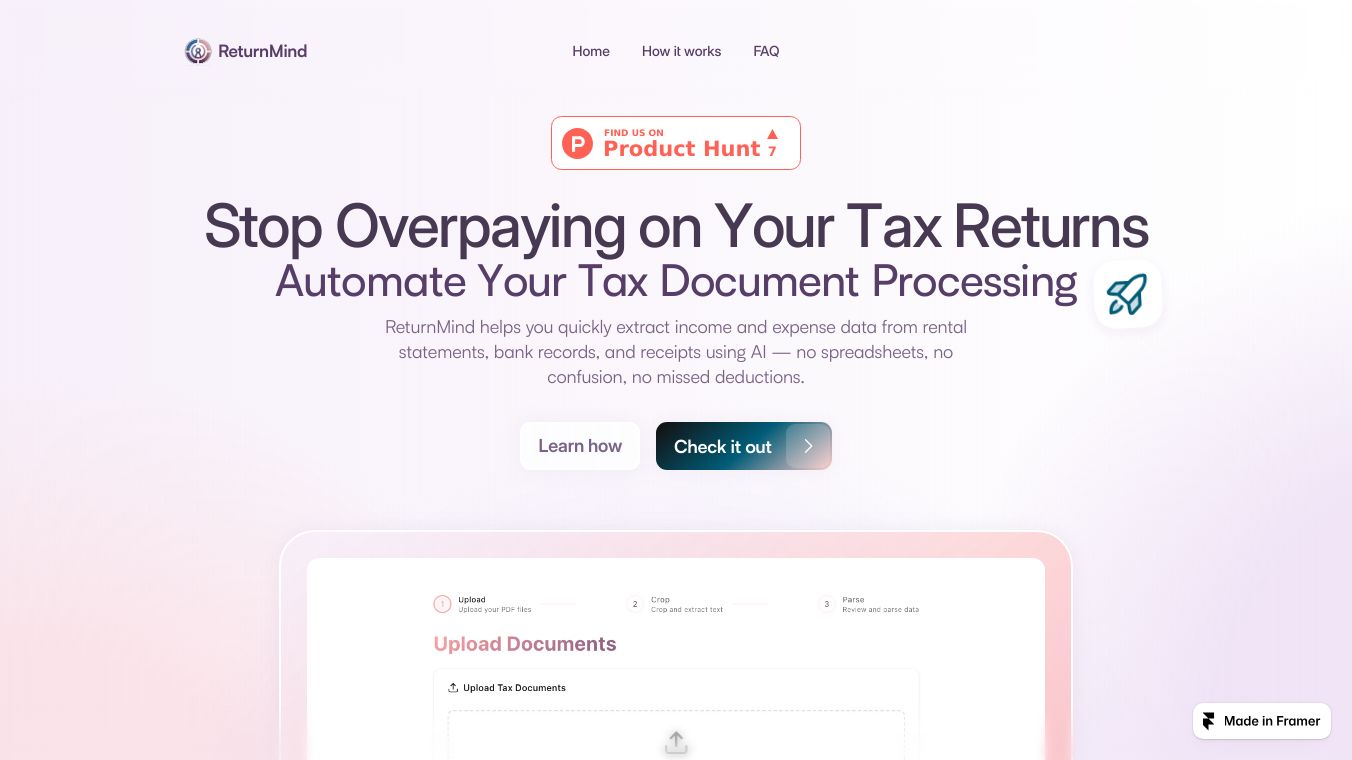

ReturnMind

ReturnMind is a smart tool designed to simplify tax document processing. It uses AI to quickly extract income and expense data from various financial documents, helping users avoid overpaying on their tax returns. With ReturnMind, there's no need for spreadsheets or manual data entry, making the tax preparation process faster and more accurate.

Benefits

ReturnMind offers several key advantages:

- Ease of Use: Create an account in minutes and start uploading tax documents right away.

- Smart Document Recognition: The tool recognizes and processes different types of financial documents, including rental statements, bank records, and receipts.

- Automated Processing: Instantly parse and generate customizable income and expense reports, reducing the risk of missed deductions.

- Security: ReturnMind prioritizes user privacy, never storing personal data without consent and verifying documents before processing.

- Customer Support: Users have access to always-on, expert support to guide them through setup and answer any questions.

Use Cases

ReturnMind is ideal for individuals and small business owners who need to manage their tax documents efficiently. It can be used to process a variety of financial documents, including:

- Rental statements

- Bank statements

- Receipts

- Invoices

- Contractor payments

- Other tax-related financial documents

Vibes

ReturnMind has been well-received for its user-friendly interface and efficient document processing capabilities. Users appreciate the tool's ability to simplify the tax preparation process and reduce the risk of errors. The always-on customer support has also been highlighted as a valuable feature, ensuring users get the help they need when they need it.

Additional Information

ReturnMind is a document processing tool only and does not provide tax advice. Users are recommended to consult with a qualified tax professional for tax-related questions or concerns.

Comments

Please log in to post a comment.