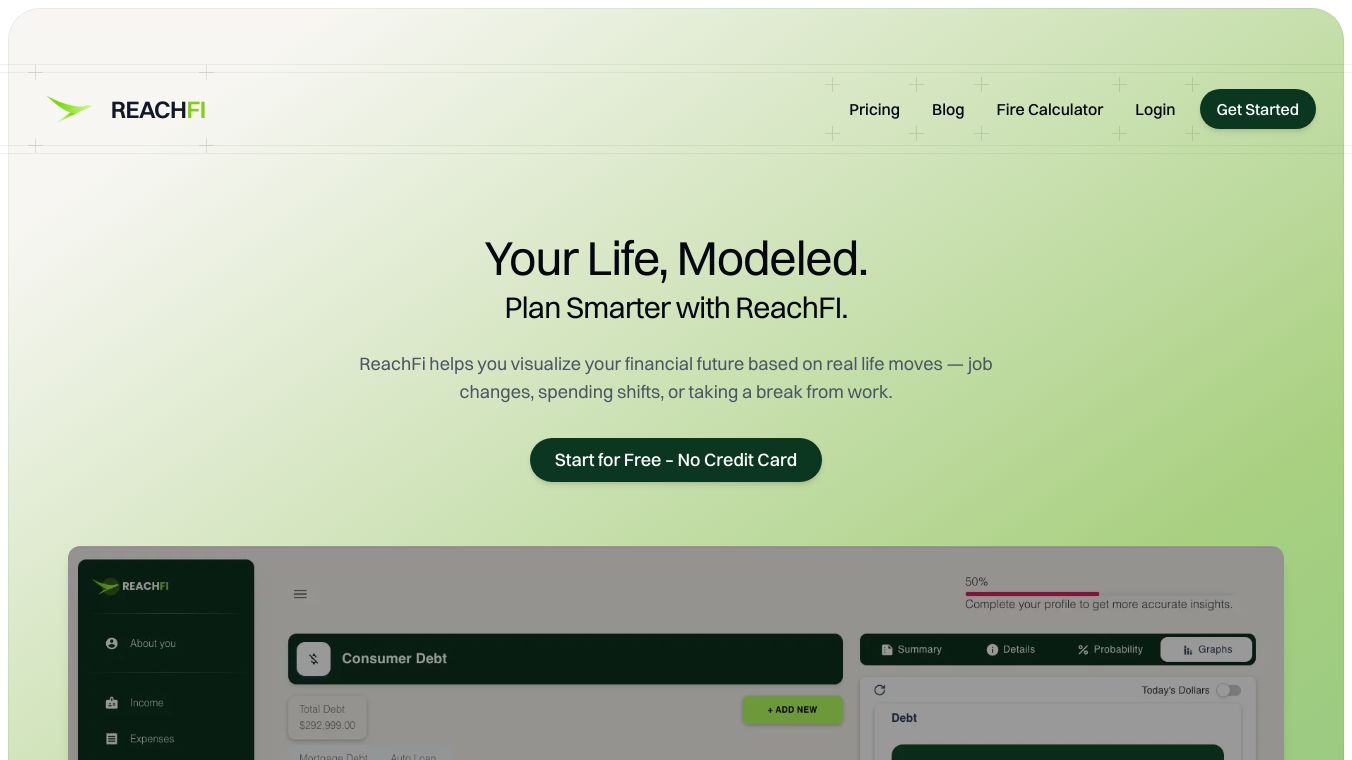

ReachFI

What is ReachFI?

ReachFI is a financial planning tool designed to help you visualize and plan your financial future. It allows you to project your net worth, track your journey to financial independence, and analyze how major life decisions impact your long-term goals. Whether you're planning for early retirement, buying a house, or managing debts, ReachFI provides insights to help you make informed financial decisions.

Benefits

Project Your Financial Future

ReachFI lets you see how your financial situation will evolve over time. You can project your net worth and liquid net worth for 5, 10, or even 20 years into the future. This helps you plan for big purchases and ensure your financial goals stay on track.

Debt Management

Keep track of your debts and expenses with ReachFI. Create a simple plan to pay off your debts and see how long it will take to become debt-free. This feature helps you stay on top of your financial obligations and work towards a debt-free life.

Major Financial Decisions

ReachFI helps you understand how significant financial decisions, such as buying a house or changing jobs, affect your long-term goals. You can adjust your income, purchases, and expenses to see how each choice shapes your financial future.

Tax Projections

Forget spreadsheets. ReachFI handles tax projections for you, ensuring a clear financial picture without the hassle. This feature helps you understand how much you will owe in taxes as your income or withdrawals increase.

Early Retirement Planning

Use Monte Carlo simulations to see the odds of hitting your early retirement goals. ReachFI tests thousands of possible financial outcomes to help you understand how your choices today can affect your future. This feature helps you adjust your plans for a smoother path to retiring sooner.

Lifestyle Goals

Experiment with your expenses to find the balance that suits your lifestyle while keeping your financial goals on track. Adjust different costs, like travel, dining, or housing, to tailor your spending to maximize both your current comfort and future savings.

Detailed Expense Tracking

Modify your expenses to suit every stage of life. From adjusting for early career budgets to expanding for family growth or scaling back for retirement, ReachFI allows you to adapt your expenses dynamically.

Projections

Visualize your financial trajectory with ReachFI's projection tool. See how your income, expenses, and savings choices today will impact your net worth and financial stability in the future. Make informed decisions now to reach your long-term goals with confidence.

Net Worth Tracker

Track your net worth over time to see how your financial decisions impact your overall wealth. By monitoring your assets, debts, and investments, you can make informed choices to grow your net worth and reach your financial goals faster.

Use Cases

Lifestyle Adjustments

A couple adjusted their dining-out budget and discretionary expenses. ReachFI showed how small lifestyle changes could speed up their path to early retirement.

Income Analysis

A freelancer input fluctuating income streams and jobs into ReachFI, helping them visualize how their annual earnings and side gigs affect long-term goals.

Contribution Analysis

A family increased their 401(k) contributions to see how it would impact their retirement savings while still meeting short-term goals like college funds.

Scenario Planning

A near-retiree ran different income and expense scenarios through ReachFI to determine the best time to stop working while maintaining financial security.

Job Comparison

A professional used ReachFI to compare two job offers, revealing the impact on long-term savings, net worth, and future career potential.

House Purchase

A homebuyer ran two house-buying scenarios through ReachFI, calculating the long-term financial impact of mortgage, taxes, and costs on overall savings.

Car Purchase

A car buyer evaluated two car purchases with ReachFI, comparing the future effects of loan payments, maintenance costs, and overall financial goals.

Data Privacy and Security

ReachFI is dedicated to data security and never sells your data. The subscription-based model prioritizes data protection. While ReachFI collects data in an aggregated way during web visits for analytics purposes, it guarantees that no personally identifiable information is used or shared with third parties.

ReachFI does not require your social security number, address, or any other personally identifiable information, such as your real name or account number. To assist with your financial planning, ReachFI only collects essential information: your email and just numbers from your portfolio—anything with a dollar sign. This empowers ReachFI to unlock powerful insights, transforming raw numbers into a crystal-clear vision of your financial future.

The services are hosted by top cloud providers, and you can review their security policies for added assurance.

Comments

Please log in to post a comment.