Payfi

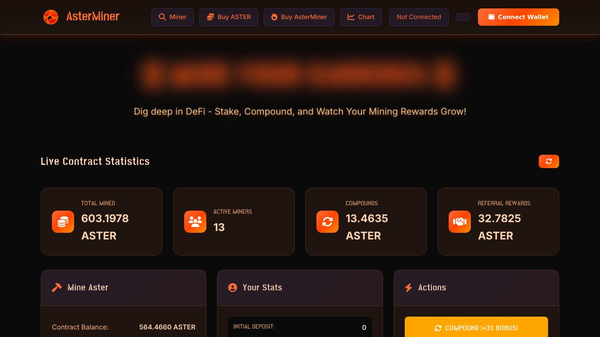

PayFi, or Payment Finance, is a clever solution that uses blockchain technology to make financial transactions quicker, more effective, and often cheaper. It focuses on real time settlement and connecting decentralized finance with real world assets. This addresses the limitations of both systems. PayFi helps users unlock the time value of money through decentralized finance. This offers instant access to future cash flows for reinvestment.

Key Features

PayFi uses the time value of money, a basic financial concept that shows money today is more valuable than the same amount in the future. This is because money invested now can generate higher returns compared to money received later, which decreases in value over time due to inflation.

Solana supports PayFi with high performance, deep liquidity, and a growing developer community. Key requirements for a blockchain to support PayFi include:

- High Performance Near instant settlements and fast block times 400 milliseconds allow Solana to process over 100000 transactions per second.

- Capital Liquidity Solana''s ecosystem provides ample liquidity, with a total value locked above 6 billion dollars.

- Talent Liquidity Solana has a strong developer community, with the number of active developers growing significantly.

Benefits

PayFi offers several benefits, including:

- Instant Liquidity Businesses can access instant liquidity by tokenizing their invoices or receivables and using them as collateral on blockchain based platforms.

- Creator Monetization Content creators can finance their productions by providing funds upfront, which they can repay based on the revenue generated from their content.

- Credit Building Payfi''s rent reporting platform ensures that every rent payment made on their platform is reported to Equifax, contributing to the tenant''s credit score.

Use Cases

Buy Now Pay Never

This model allows users to benefit from the time value of money principle by committing future earnings toward a purchase. For example, instead of paying upfront for a product, users can agree to pay monthly installments. These payments are used to purchase yield bearing stablecoins, which generate interest. Over time, the accumulated interest and principal cover the cost of the product.

Accounts Receivable Financing

PayFi introduces a decentralized approach to accounts receivable financing, allowing businesses to access instant liquidity by tokenizing their invoices or receivables and using them as collateral on blockchain based platforms. This helps businesses maintain a financial cushion and avoid operational failures due to delayed payments.

Creator Monetization

PayFi can help content creators finance their productions by providing funds upfront, which they can repay based on the revenue generated from their content. This allows creators to continuously deliver content without waiting for their next pay.

Cost/Price

The article does not provide specific cost or price information for PayFi.

Funding

The article does not provide specific funding details for PayFi.

Reviews/Testimonials

The article does not provide specific reviews or testimonials for PayFi.

Comments

Please log in to post a comment.