Net30

What is Net30?

Net30 is a common payment term used on invoices to indicate that a customer has 30 days to pay for goods or services received. This term is a shorthand way of communicating payment expectations and is widely used in business operations, particularly in accounting and customer communication.

Benefits

Net30 offers several advantages for both businesses and customers:

- Clear Communication: Net30 provides a straightforward and universally understood payment term, ensuring that customers know exactly when payment is due.

- Flexibility: Businesses can adjust the payment terms based on customer relationships and trust, offering longer or shorter payment periods as needed.

- Improved Cash Flow: By setting clear payment terms, businesses can better manage their cash flow and predict incoming payments.

- Automation: Modern invoicing tools can automate the process of sending reminders, applying late fees, and tracking overdue invoices, saving time and reducing administrative burdens.

Use Cases

Net30 is commonly used in various business scenarios:

- B2B Transactions: Many businesses use Net30 terms when invoicing other businesses, allowing for a standard payment period that aligns with typical accounting cycles.

- Retail and Wholesale: Retailers and wholesalers often use Net30 terms to manage inventory and cash flow effectively.

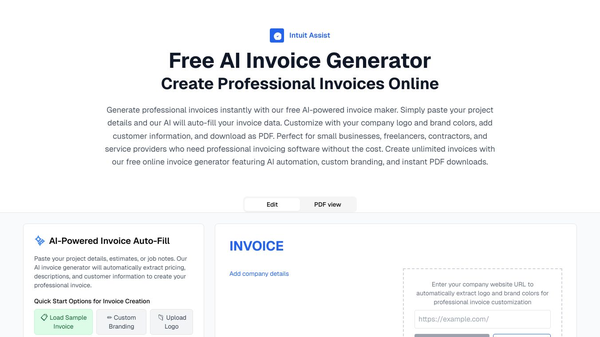

- Service Industries: Service providers, such as consultants and freelancers, may use Net30 terms to give clients a reasonable time to pay for services rendered.

- Industry-Specific Terms: Different industries may have varying standards for payment terms, and Net30 can be adjusted to meet those expectations.

Additional Information

Net30 is just one of several payment terms that businesses can use. Other common terms include Net10, Net20, and Net60, indicating payment due in 10, 20, or 60 days, respectively. Businesses can also use variations like Net30 EOM (End of Month), which means payment is due 30 days after the end of the month in which the invoice was issued.

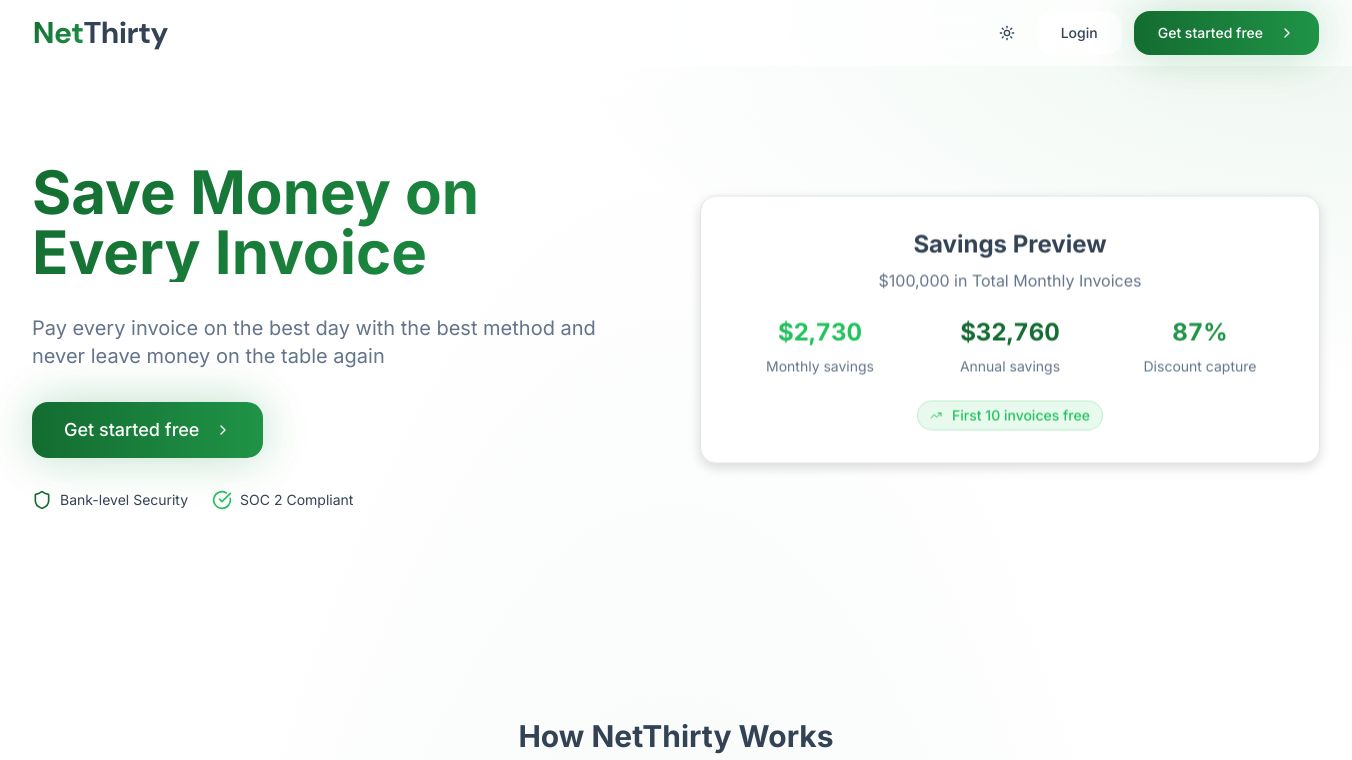

Using invoicing and accounting software can help businesses manage Net30 terms more efficiently. These tools can automate reminder emails, track overdue invoices, and provide detailed reports on accounts receivable. By leveraging these tools, businesses can improve their cash flow and ensure timely payments from customers.

This content is either user submitted or generated using AI technology (including, but not limited to, Google Gemini API, Llama, Grok, and Mistral), based on automated research and analysis of public data sources from search engines like DuckDuckGo, Google Search, and SearXNG, and directly from the tool's own website and with minimal to no human editing/review. THEJO AI is not affiliated with or endorsed by the AI tools or services mentioned. This is provided for informational and reference purposes only, is not an endorsement or official advice, and may contain inaccuracies or biases. Please verify details with original sources.

Comments

Please log in to post a comment.