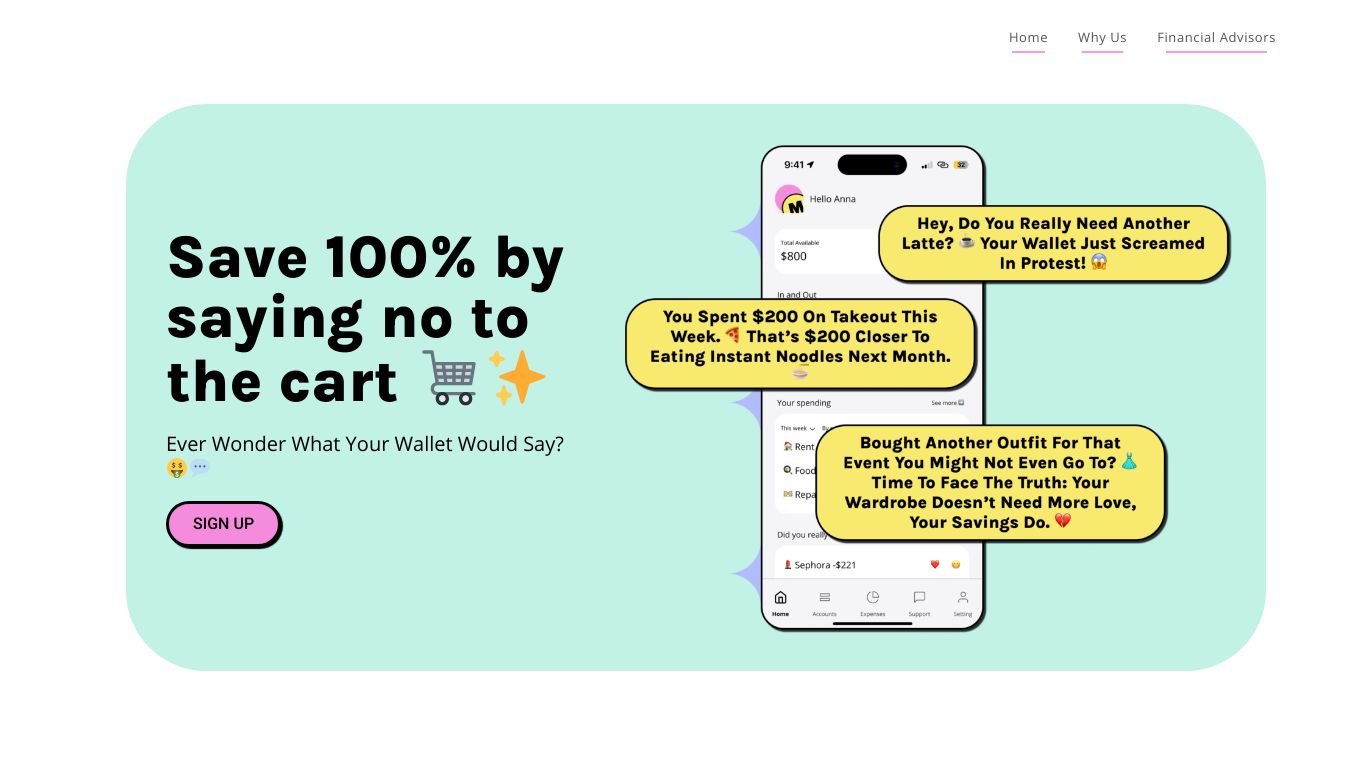

Moneta Lend

Moneta Lend is a fun and helpful budgeting app that makes managing your money easy. Unlike other budgeting apps, Moneta Lend is like a friendly buddy that gives you real-time feedback and tips to keep your spending in check. It uses smart tech to gently guide you away from impulse buys, helping you save up to 60% on your spending. Whether it''s dining out too much or buying a new gaming console, Moneta Lend offers funny and honest comments to keep you on track.

Key Features

Real-Time Accountability

Moneta Lend is special because it offers real-time accountability. The app tracks and comments on your spending right away, keeping you aware of your habits.

Custom Spending Goals

You can set spending limits for different categories or even for individual stores. Moneta Lend watches these limits and alerts you if you are spending too much.

Insights That Matter

The app gives you detailed reports and smart insights, making financial planning easier and more fun.

Secure and Private

Moneta Lend only reads your account information, ensuring that no sensitive data is stored or shared. The app uses strong encryption to protect your data.

Benefits

Moneta Lend helps you make smarter spending choices and reach your financial goals. Whether you want to cut down on impulse buys or pay off debt, Moneta Lend is your partner in financial success.

Use Cases

Moneta Lend is great for anyone who wants to control their spending habits. It''s especially useful for those who want to save money, pay off debt, or be more mindful of their spending. Financial advisors can also use Moneta Lend to help their clients set realistic spending goals.

Cost/Price

Moneta Lend is available through a subscription model. The app costs $5 per month when you sign up through a referral link, or $7 per month otherwise. The subscription covers the costs of secure tools and services that power the user experience.

Funding

There are no fees or hidden costs for financial advisors to use Moneta Lend.

Reviews/Testimonials

Users love Moneta Lend''s real-time accountability and insightful reports, which help them make smarter spending decisions and achieve their financial goals. The app''s friendly buddy approach makes financial planning less stressful and more engaging.

Comments

Please log in to post a comment.