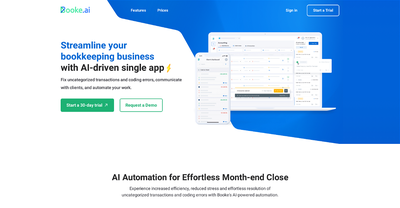

Bookeeping.ai

Bookeeping.ai is a financial management tool that uses AI to make accounting tasks easier. It can do up to 95% of common bookkeeping jobs like putting in transactions, filling out tax forms, and scanning documents. This tool is great for small business owners, freelancers, and accountants. It helps them save time and money while making their work more accurate and productive.

Benefits

Bookeeping.ai has several key advantages. It can do tasks like putting in transactions, filling out tax forms, scanning documents, and making invoices. This means less work for you. It gives you up-to-date financial reports and advice on taxes. This helps you know about your financial health. It also checks your books all the time and gives you tips to fix errors and save on taxes. You can do accounting tasks with simple chat commands. This makes it easy to use and productive. It works with over 5000 banks in the US and Canada and connects with many apps to put in transaction data easily. It has future features like easy tax form collection, E-signatures, and simple tax filing. These will make financial work even easier.

Use Cases

Bookeeping.ai is useful in many ways. It helps small business owners manage financial tasks. This lets them focus on growing their business. It automates receipt matching, invoice creation, and expense tracking for freelancers. This makes financial management simpler. It gives accountants real-time updates on books. This helps them spot errors and find tax savings.

Pricing

Bookeeping.ai starts at 29 dollars per month after a 30-day free trial. It is available on both Android and iOS devices. It offers 24/7 customer support via chat and email.

Vibes

Users like the time-saving features and how easy it is to use. The chat-based commands and real-time financial insights are especially liked. Some users say that certain advanced features are still being developed. There may be a learning curve for those used to traditional accounting software.

Additional Information

Bookeeping.ai uses strong security measures. This includes encryption and SOC 2-certified providers to keep data safe. The platform tracks every change with a detailed log for full transparency. It provides automatic hourly backups of all financial data. It can work with multiple accounting platforms and connect with over 5000 banks in the US and Canada. Users can add their tax specialist or team and set custom permissions. The dashboard can be changed to fit user needs with drag-and-drop widgets.

Comments

Please log in to post a comment.