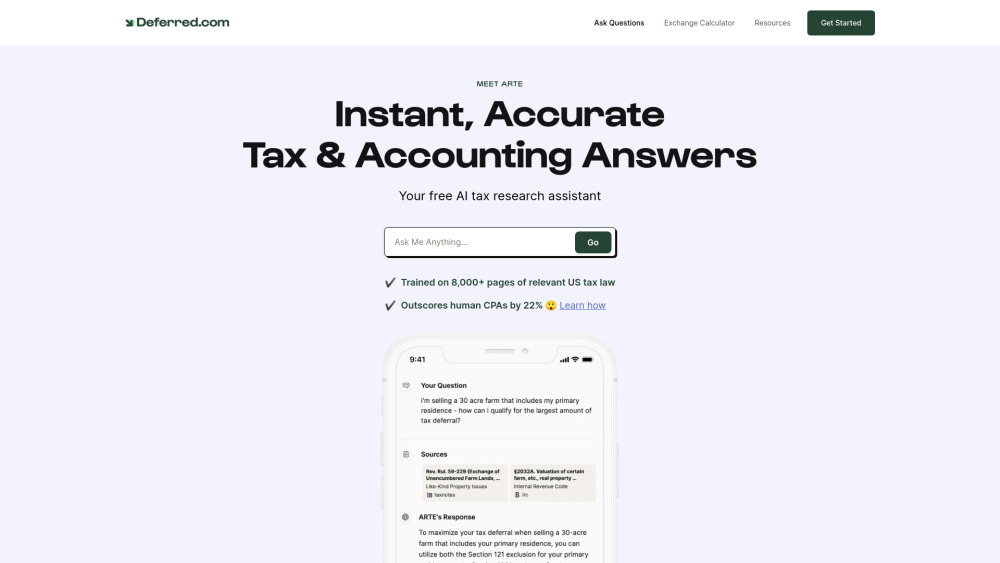

ARTE - AI Real Estate Tax Expert and Research Assistant

ARTE (AI Real Estate Tax Expert) is a sophisticated artificial intelligence chatbot designed by Deferred.com to support real estate investors with tax-related queries, especially those concerning 1031 exchanges. Leveraging OpenAI's GPT-4 and trained on more than 8,000 pages of pertinent US tax law, ARTE operates as a virtual tax expert accessible 24/7, delivering precise and detailed responses to intricate tax issues. It is engineered to provide superior, quicker, and more economical tax counsel compared to conventional CPA services.

ARTE is not only an AI-powered real estate tax expert but also a research assistant chatbot that furnishes immediate, accurate solutions to complex tax and accounting inquiries. With its extensive training on over 8,000 pages of US tax law, ARTE excels human CPAs by 22% on benchmark CPA Exam tests. It offers fully researched responses complete with citations to source documents, making it a quicker and more cost-effective alternative to consulting a human CPA.

Highlights:

- AI-powered real estate tax expert and research assistant

- Trained on over 8,000 pages of US tax law

- Outperforms human CPAs by 22% on benchmark CPA Exam tests

- Offers free AI tax research assistance

- Specializes in 1031 exchanges

Key Features:

- Utilizes OpenAI GPT-4

- Provides instant, fully-researched answers with citations

- Free access to users

- Specialized in 1031 exchanges

- 24/7 availability

Benefits:

- Faster and more cost-effective tax advice

- 24/7 availability for instant tax research assistance

- Highly accurate information backed by extensive training

- Immediate responses to complex tax questions

- Detailed information and guidance on 1031 exchange processes

Use Cases:

- Real estate investors seeking tax advice

- Tax professionals needing research assistance

- Property managers handling tax inquiries

- Individuals with complex tax situations

- Consulting on 1031 exchanges

Comments

Please log in to post a comment.