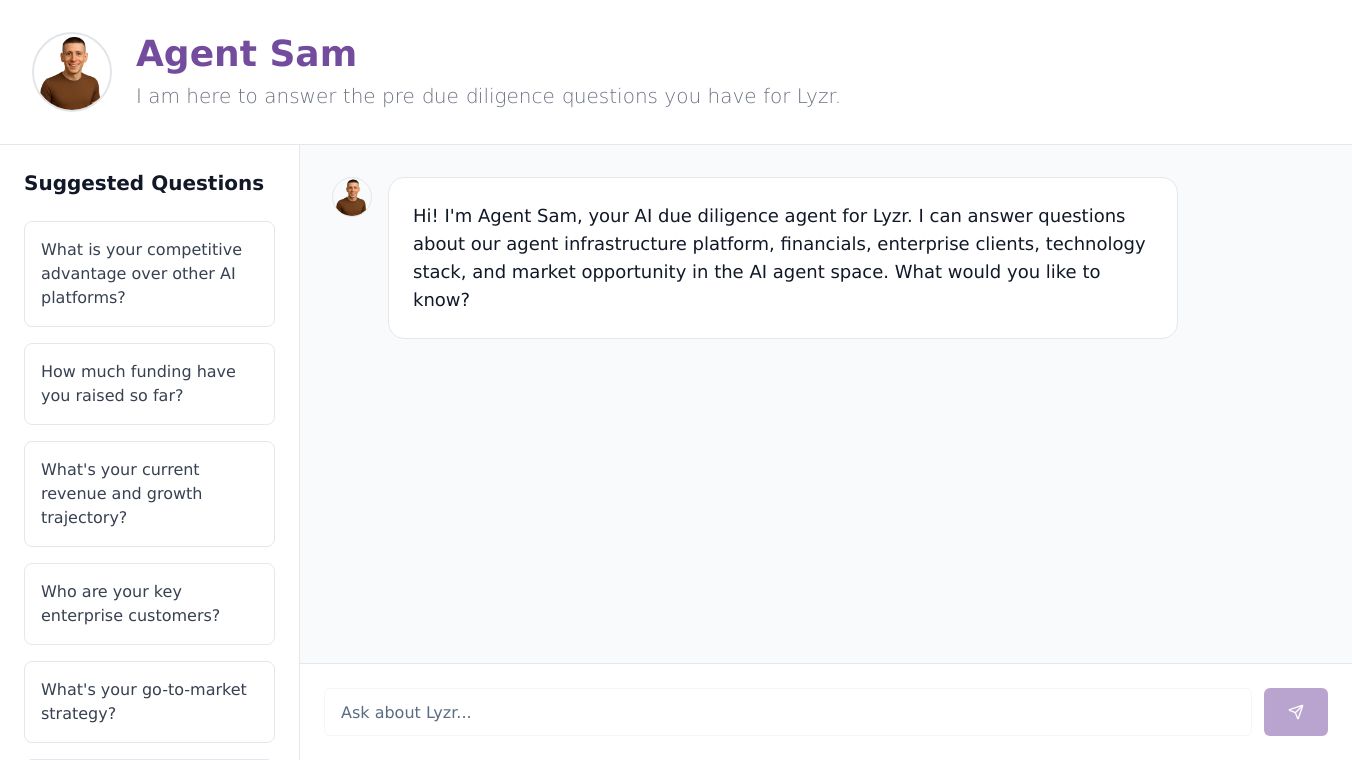

Agent Sam

Agent Sam: Revolutionizing Investor Engagement with AI

Agent Sam is an AI-powered tool developed by Lyzr, an enterprise AI agent platform designed for real-world deployment. This innovative AI agent is specifically created to manage investor engagement, respond to due diligence queries, and provide real-time operational insights. By placing an AI agent at the forefront of its fundraising efforts, Lyzr is shifting the focus from traditional founder-led pitches to product-driven execution.

Benefits

Agent Sam offers several key advantages for both Lyzr and its investors:

- Efficient Investor Engagement: Agent Sam handles investor interactions, allowing the Lyzr team to focus on other critical aspects of the business.

- Real-Time Insights: The AI agent provides up-to-date operational insights, giving investors a clear view of the company's performance and capabilities.

- Transparency and Control: Through interactive sessions, Agent Sam presents financial data, explains product decisions, and demonstrates how agent workflows are governed, monitored, and explainable in real time.

- Direct Access to Capabilities: Investors gain direct access to the same production-grade capabilities that Lyzr provides to enterprises.

Use Cases

Agent Sam is primarily used to streamline the fundraising process and enhance investor relations. The AI agent can:

- Manage Investor Queries: Respond to due diligence questions and provide detailed information about Lyzr's products and operations.

- Present Financial Data: Offer real-time financial insights and performance metrics.

- Explain Product Decisions: Clarify the reasoning behind product choices and development strategies.

- Demonstrate Workflows: Show how agent workflows are governed, monitored, and explainable in real time.

Additional Information

Lyzr, the company behind Agent Sam, has made significant strides in the AI agent space. Since the launch of its no-code Agent Studio in January 2025, Lyzr has supported over 15,000 builders and 1,800 organizations. The platform integrates deterministic planning, telemetry, and hallucination control into every agent deployment, addressing common failure points in enterprise AI. Lyzr agents are operational in high-stakes environments, such as optimizing seat allocation for a global airline, automating research and scoring for a systems integrator's venture desk, and developing retirement-planning agents for a Fortune 500 insurance and advisory firm.

The company's Blueprint Library enables each agent to become a governed, reusable template with enforcement policies built in. These blueprints are supported by two provisional patents and are part of a compounding system that improves over time. Lyzr's cloud-agnostic architecture supports deployment across AWS, GCP, on-premise environments, and NVIDIA infrastructure.

Lyzr is initially focused on the financial services sector, where auditability, compliance, and governance are critical. As part of the 2025 FinTech Innovation Lab NYC cohort, the company offers production-grade blueprints for core workflows like loan origination, KYC, and regulatory reporting. Its industry-specific super agents, Amadeo for banking and Benji for insurance, combine LLMs with deterministic logic to handle high-stakes tasks with transparency and control.

With 60 paying customers and $1.5 million in annual recurring revenue, Lyzr is on track to reach $2 million this quarter and expects to break even by August 2025. The company is scaling deliberately through product maturity and blueprint reuse, not just capital expansion. Agent Sam is live and actively managing investor discussions. Interested parties can connect with the agent directly to begin the diligence process. The Series A round is underway, with early interest already committed.

Comments

Please log in to post a comment.